Electronic Remittance Advice (ERA) is revolutionising the way healthcare providers manage their financial transactions. As a digital document sent by health insurance providers, an ERA details the payments and adjustments related to claims submitted by healthcare practitioners. This modern approach replaces traditional paper remittance advice, significantly enhancing efficiency and accuracy in medical billing processes.

ERA stands for Electronic Remittance Advice. It is an electronic document that provides a comprehensive explanation of the payment decisions made by health plans regarding claims submitted by healthcare providers [1]. Typically formatted as an ANSI 835 file, an ERA includes crucial information such as:

The ERA streamlines the communication between insurers and healthcare providers, allowing for quicker access to detailed financial data without the need for paper documents.

To better understand ERA, it's helpful to compare it with its paper counterpart, the Explanation of Benefits (EOB). An EOB is a document generated by insurance companies when they process a claim, detailing the patient's information, service date, billed charges, allowed amount, and the amount paid to the provider. It also outlines the patient's responsibility, including any deductible, co-payment, or coinsurance, along with any adjustments or denials and their explanations.

ERA is essentially a digital version of the EOB formatted for direct posting into the practice's billing system. This enables the automated import of EOB receipts from health insurance providers into practice management software, directly matching payments to debtor accounts in a structured format [7].

Implementing ERAs in your medical practice can yield numerous advantages:

For private medical insurance companies that do not support ERA functions, many practice management software systems offer the ability to create manual ERAs. This feature allows you to post receipts to multiple debtor accounts simultaneously, rather than processing each invoice receipt individually. This flexibility ensures that practices can benefit from the efficiency of ERA even when dealing with insurers that haven't yet adopted the technology.

One of the key advantages of using ERA is its ability to integrate with provincial insurance systems. For example, integration with the Ontario Health Insurance Plan (OHIP) allows for the automatic import of Remittance Advice, reducing manual data entry and improving accuracy [4]. This integration is particularly beneficial for Canadian healthcare providers, as it streamlines the billing process for publicly insured services.

At GoodX Healthcare, we understand that integrating ERA into your practice management software can seem daunting. However, our system is designed to simplify this process.

For detailed guidelines on how to manage ERAs within the GoodX platform, please refer to our instructions below:

1. Create a New ERA

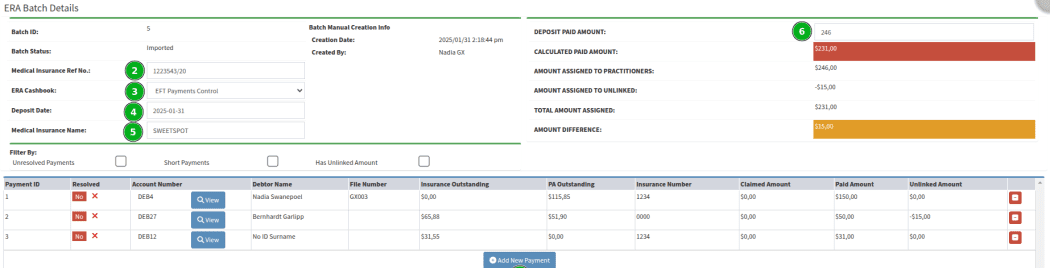

2. Input details as received from Insurance EOB

3. Save the ERA

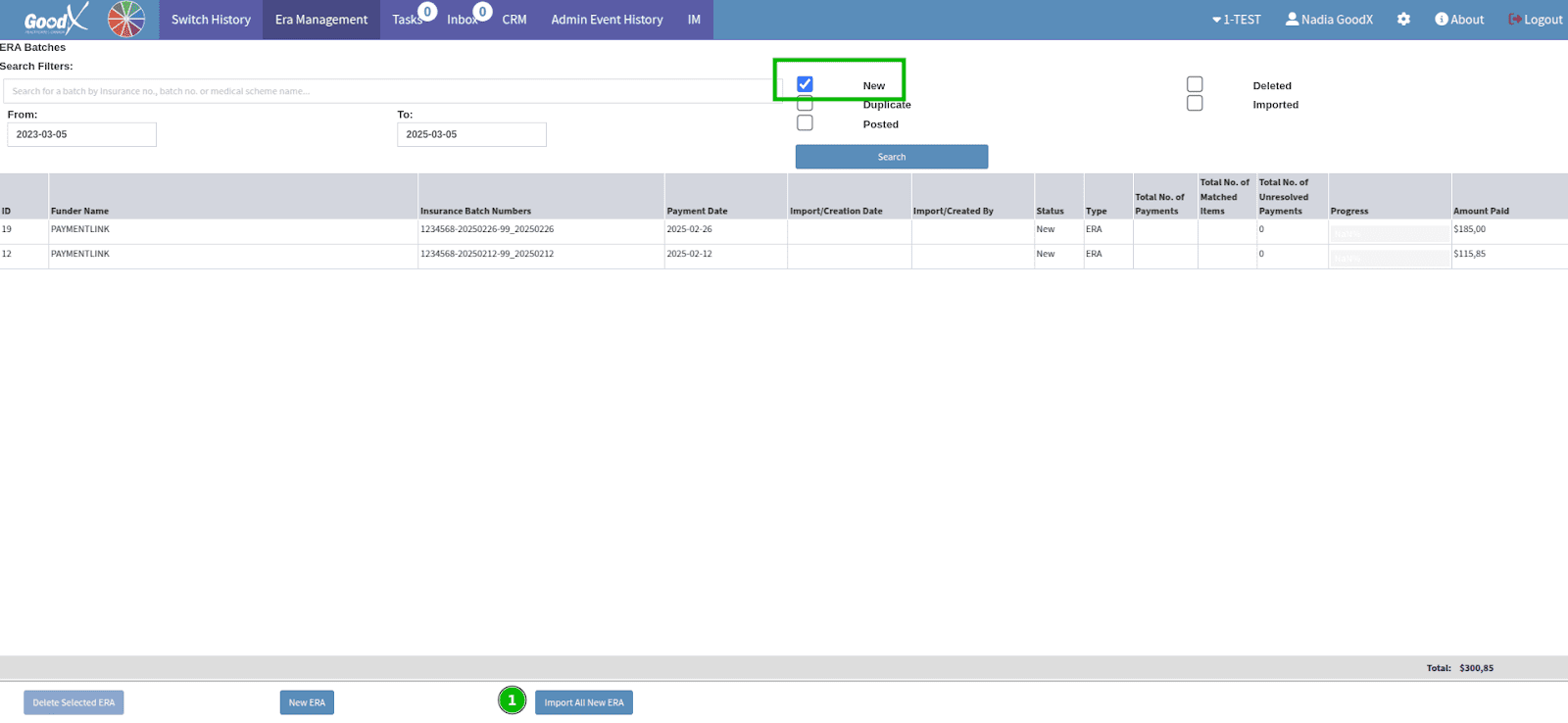

1. Import a New ERA

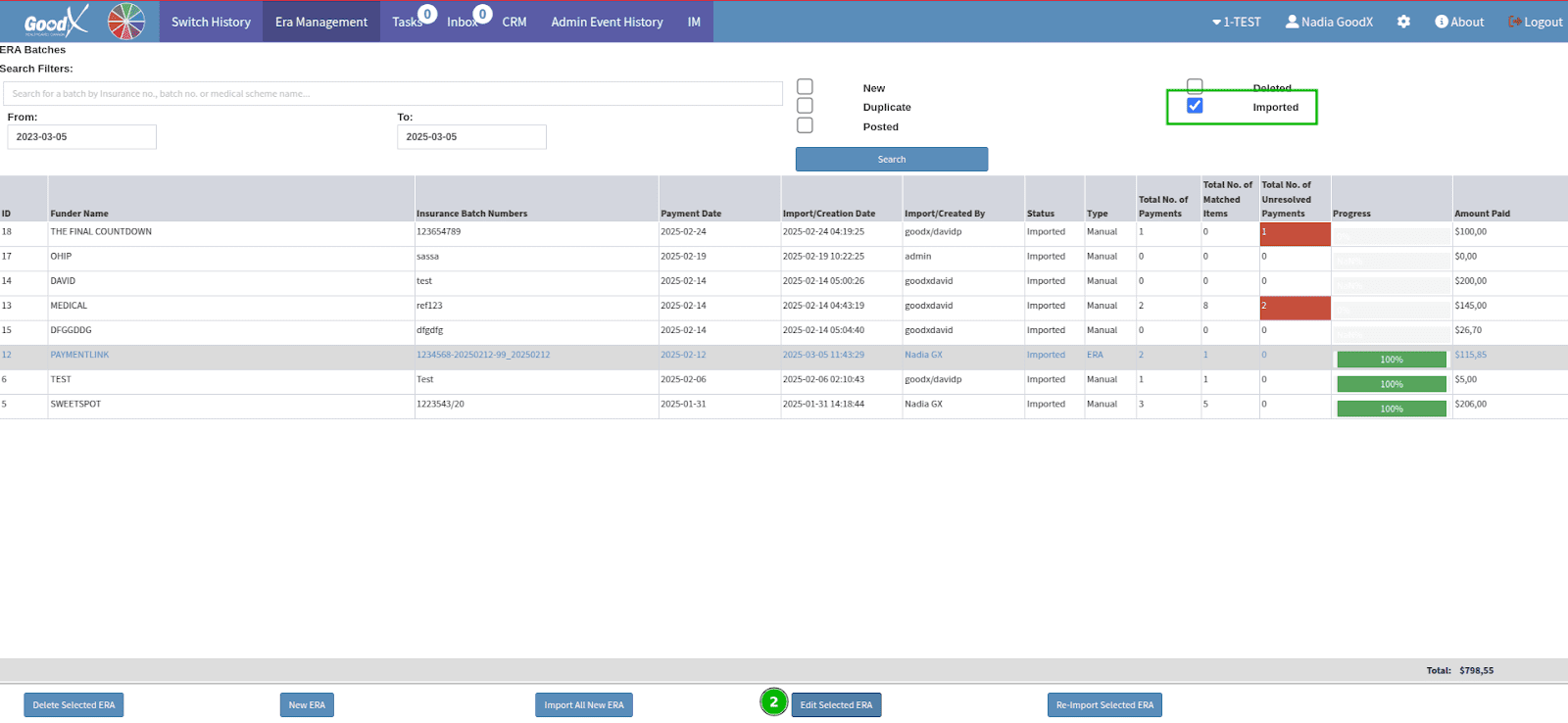

2. Edit the Imported ERA

3. Check details as received from Insurance EOB

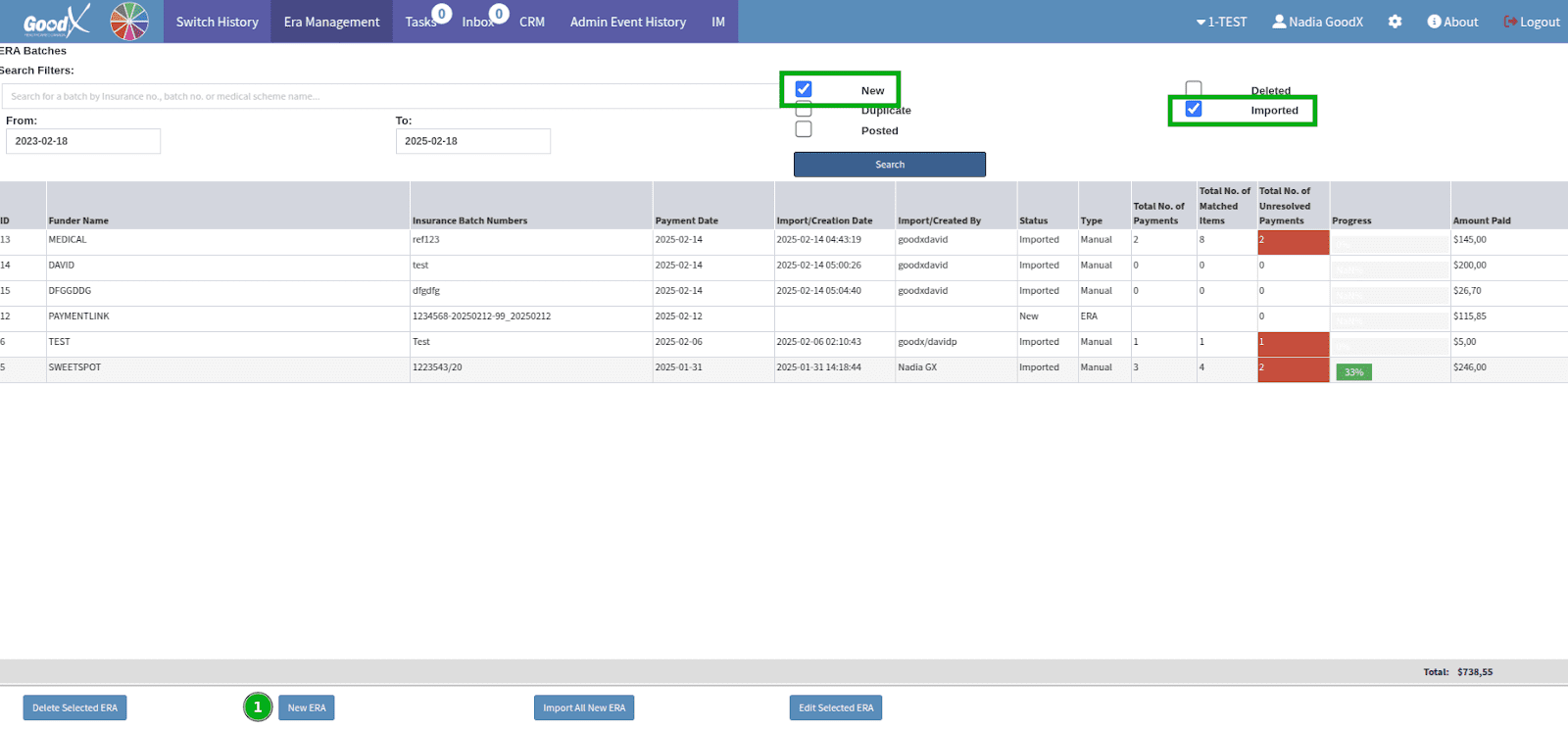

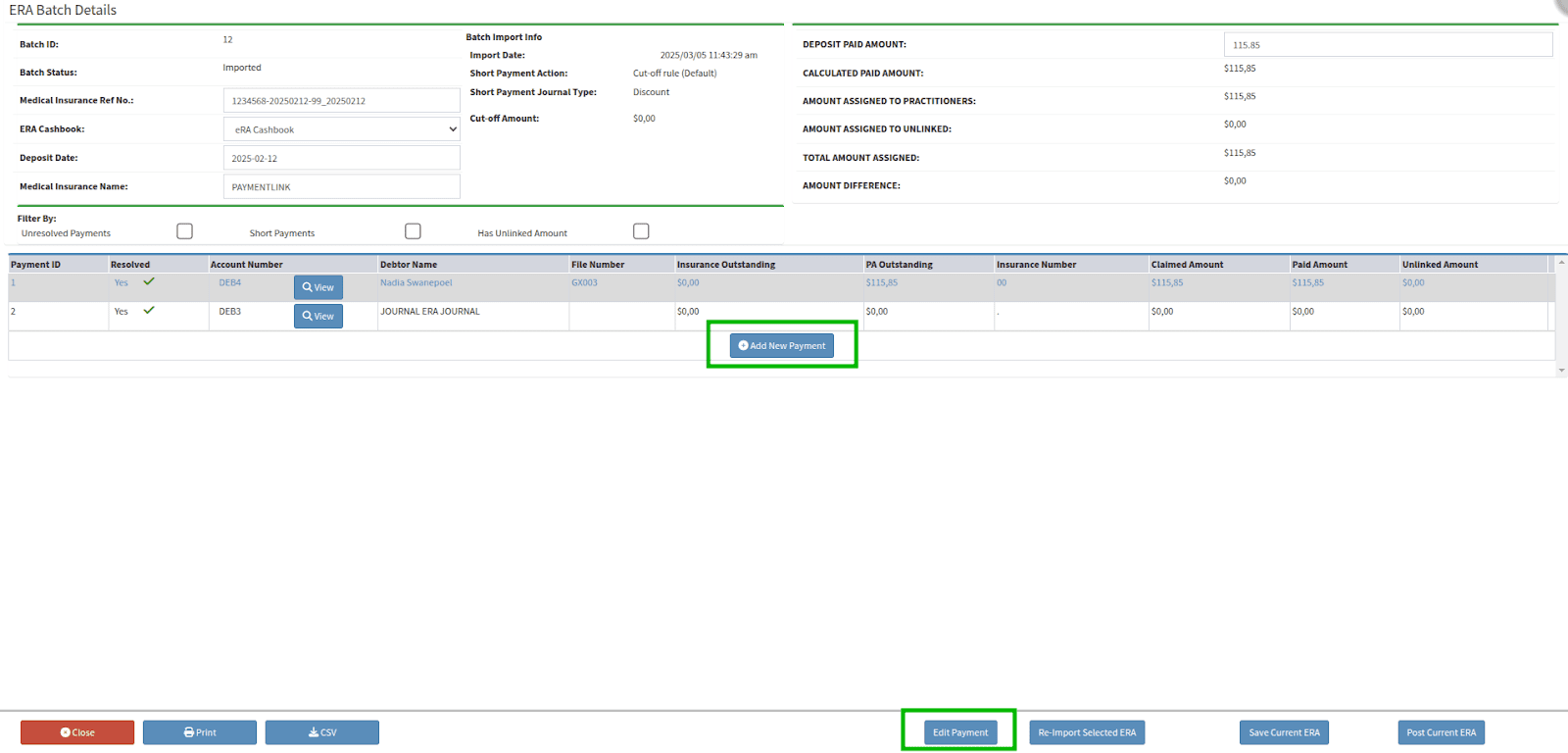

From the ERA Management screen, select the ERA to finalize (either a manually created or automatically imported ERA).

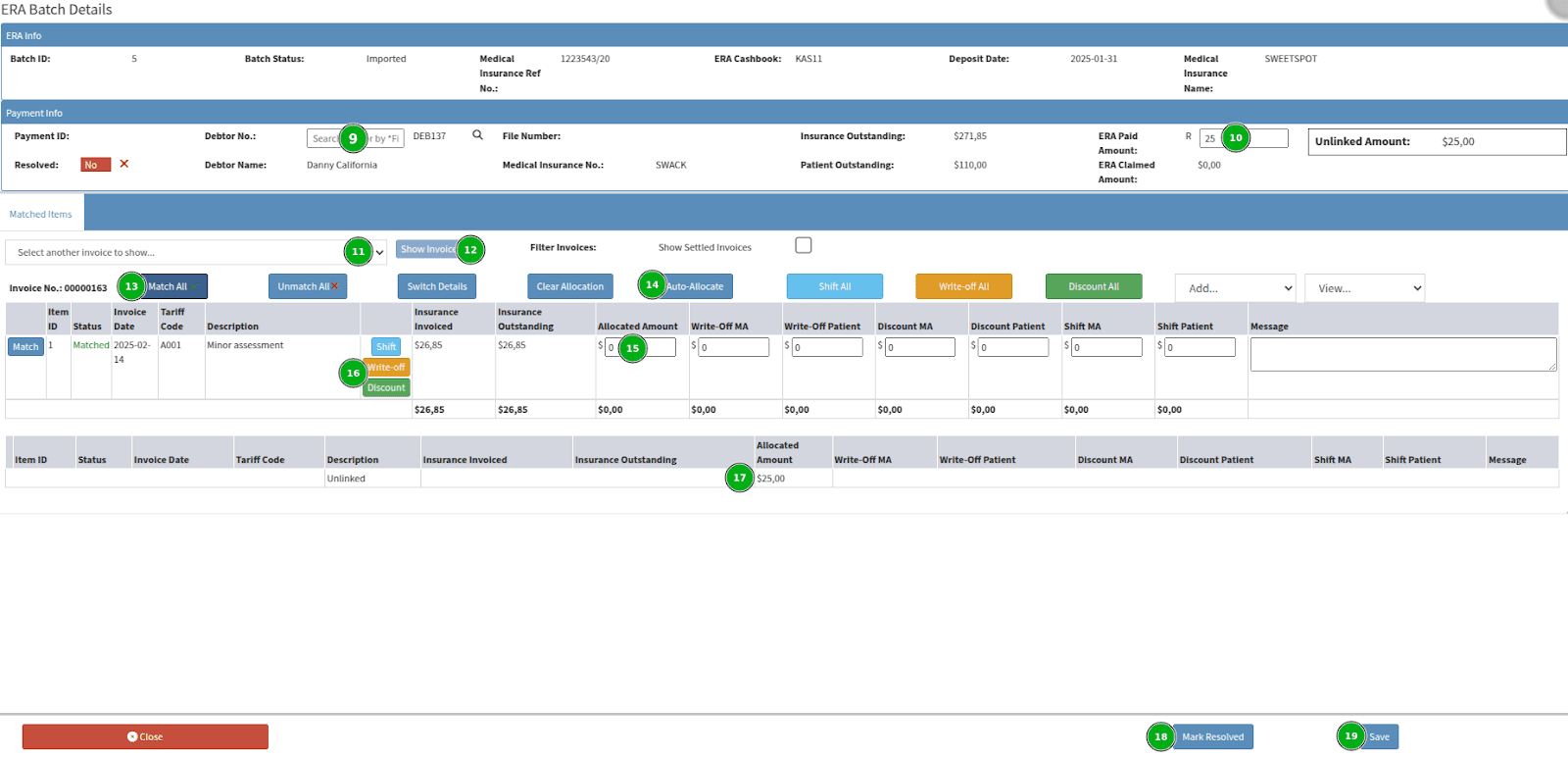

4. Add New payment / Edit existing payment

5. Add payment information

Take note of the following:

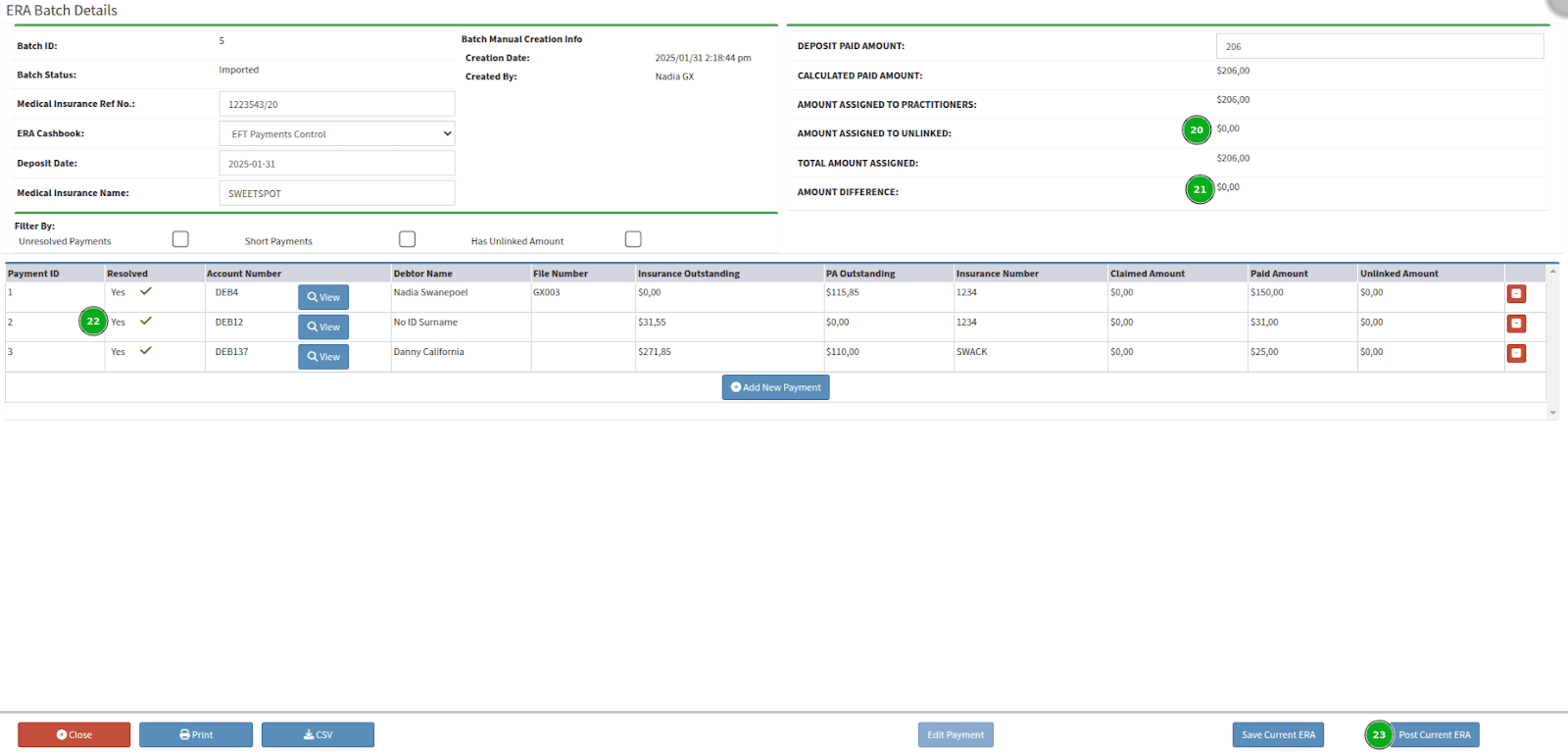

6. Post Current ERA

Check the following:

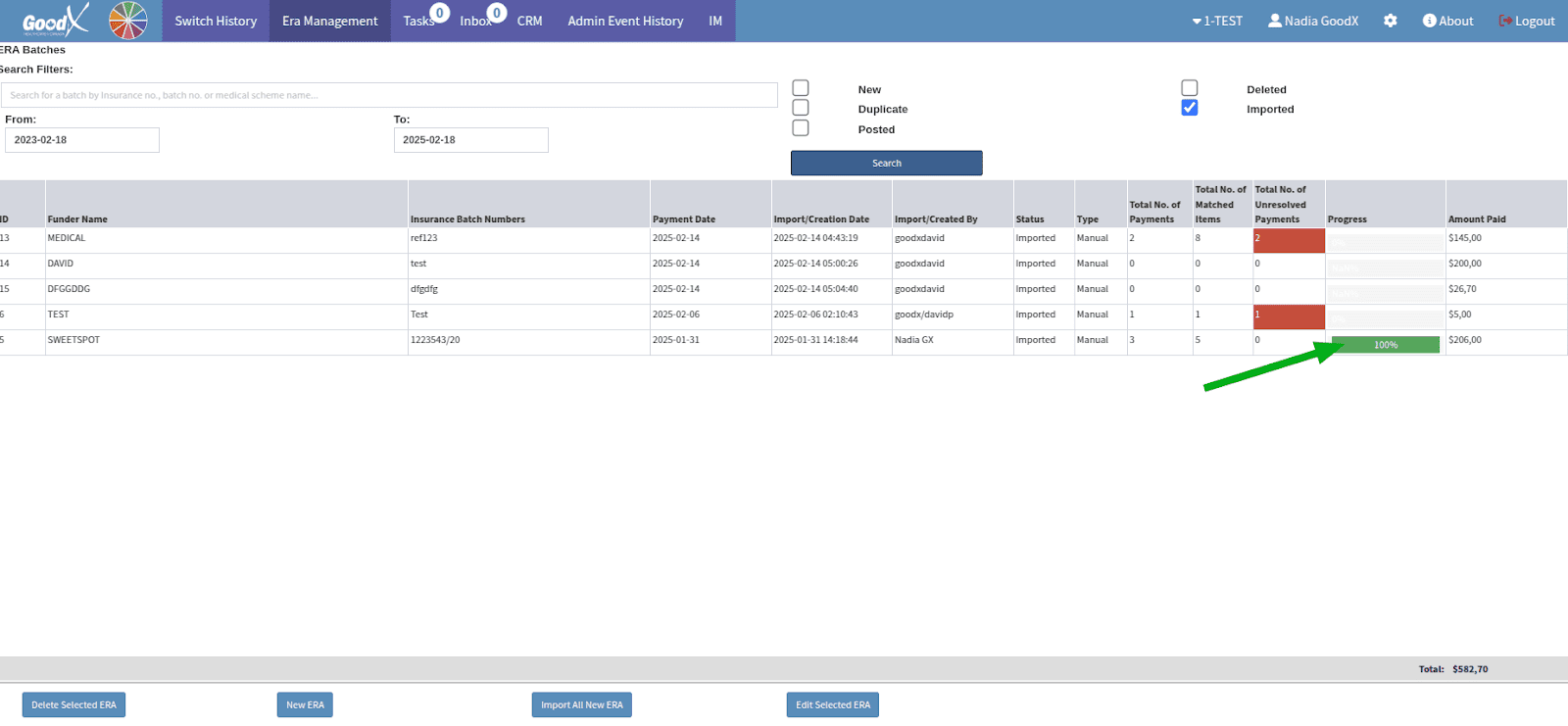

7. Progress should be 100% before posting

By leveraging the capabilities of Electronic Remittance Advice through GoodX Healthcare's software, you can enhance your practice's efficiency, improve financial management, and ultimately provide better care for your patients.

Citations: